It’s not unusual for a partner to incur expenses related to the partnership’s business. This is especially likely to occur in service partnerships such as an architecture or law firm. For example, partners in service partnerships may incur entertainment expenses in developing new client relationships. They may also incur expenses for: transportation to get to and from client meetings, professional publications, continuing education and home office. What’s the tax treatment of such expenses? Here are the answers.

Reimbursable or Not

As long as the expenses are the type a partner is expected to pay without reimbursement under the partnership agreement or firm policy (written or unwritten), the partner can deduct the expenses on Schedule E of Form 1040. Conversely, a partner can’t deduct expenses if the partnership would have honored a request for reimbursement.

Continue Reading

If you’re buying a new home, you may have thought about keeping your current home and renting it out. In March, average rents for one- and two-bedroom residences were $1,487 and $1,847, respectively, according to the latest Zumper National Rent Report.

In some parts of the country, rents are much higher or lower than the averages. The most expensive locations to rent a one-bedroom place were New York City ($4,200); Jersey City, New Jersey ($3,260); San Francisco ($2,900); Boston ($2,850) and Miami ($2,710). The least expensive one-bedroom locations were Wichita, Kansas ($690); Akron, Ohio ($760); Shreveport, Louisiana ($770); Lincoln, Nebraska ($840) and Oklahoma City ($860).

Continue Reading

Businesses usually want to delay recognition of taxable income into future years and accelerate deductions into the current year. But when is it wise to do the opposite? And why would you want to?

One reason might be tax law changes that raise tax rates. The Biden administration has proposed raising the corporate federal income tax rate from its current flat 21% to 28%. Another reason may be because you expect your noncorporate pass-through entity business to pay taxes at higher rates in the future and the pass-through income will be taxed on your personal return. There have also been discussions in Washington about raising individual federal income tax rates.

Continue Reading

Most people are genuinely appreciative of inheritances, and who wouldn’t enjoy some unexpected money? But in some cases, it may turn out to be too good to be true. While most inherited property is tax-free to the recipient, this isn’t always the case with property that’s considered income in respect of a decedent (IRD). If you have large balances in an IRA or other retirement account — or inherit such assets — IRD may be a significant estate planning issue.

How It Works

IRD is income that the deceased was entitled to, but hadn’t yet received, at the time of his or her death. It’s included in the deceased’s estate for estate tax purposes, but not reported on his or her final income tax return, which includes only income received before death.

Continue Reading

If your business doesn’t already have a retirement plan, it might be a good time to take the plunge. Current retirement plan rules allow for significant tax-deductible contributions.

For example, if you’re self-employed and set up a SEP-IRA, you can contribute up to 20% of your self-employment earnings, with a maximum contribution of $69,000 for 2024 (up from $66,000 for 2023). If you’re employed by your own corporation, up to 25% of your salary can be contributed to your account, with a maximum contribution of $69,000. If you’re in the 32% federal income tax bracket, making a maximum contribution could cut what you owe Uncle Sam for 2024 by a whopping $22,080 (32% × $69,000).

Continue Reading

If you operate a business, or you’re starting a new one, you know records of income and expenses need to be kept. Specifically, you should carefully record expenses to claim all the tax deductions to which you’re entitled. And you want to make sure you can defend the amounts reported on your tax returns in case you’re ever audited by the IRS.

Be aware that there’s no one way to keep business records. On its website, the IRS states: “You can choose any recordkeeping system suited to your business that clearly shows your income and expenses.” But there are strict rules when it comes to deducting legitimate expenses for tax purposes. And certain types of expenses, such as automobile, travel, meal and home office costs, require extra attention because they’re subject to special recordkeeping requirements or limitations on deductibility.

Continue Reading

If you have a tax-favored retirement account, including a traditional IRA, you’ll become exposed to the federal income tax required minimum distribution (RMD) rules after reaching a certain age. If you inherit a tax-favored retirement account, including a traditional or Roth IRA, you’ll also have to deal with these rules.

Specifically, you’ll have to: 1) take annual withdrawals from the accounts and pay the resulting income tax and/or 2) reduce the balance in your inherited Roth IRA sooner than you might like.

Continue Reading

Your business should generally maximize current year depreciation write-offs for newly acquired assets. Two federal tax breaks can be a big help in achieving this goal: first-year Section 179 depreciation deductions and first-year bonus depreciation deductions. These two deductions can potentially allow businesses to write off some or all of their qualifying asset expenses in Year 1. However, they’re moving targets due to annual inflation adjustments and tax law changes that phase out bonus depreciation. With that in mind, here’s how to coordinate these write-offs for optimal tax-saving results.

Sec. 179 Deduction Basics

Most tangible depreciable business assets — including equipment, computer hardware, vehicles (subject to limits), furniture, most software and fixtures — qualify for the first-year Sec. 179 deduction.

Continue Reading

Are you dreaming of buying a vacation beach home, lakefront cottage or ski chalet? Or perhaps you’re fortunate enough to already own a vacation home. In either case, you may wonder about the tax implications of renting it out for part of the year.

Count the Days

The tax treatment depends on how many days it’s rented and your level of personal use. Personal use includes vacation use by your relatives (even if you charge them market rate rent) and use by nonrelatives if a market rate rent isn’t charged.

Continue Reading

If your small business is strapped for cash (or likes to save money), you may find it beneficial to barter or trade for goods and services. Bartering isn’t new — it’s the oldest form of trade — but the internet has made it easier to engage in with other businesses.

However, if your business begins bartering, be aware that the fair market value of goods that you receive in these types of transactions is taxable income. And if you exchange services with another business, the transaction results in taxable income for both parties.

Continue Reading

The qualified business income (QBI) deduction is available to eligible businesses through 2025. After that, it’s scheduled to disappear. So if you’re eligible, you want to make the most of the deduction while it’s still on the books because it can potentially be a big tax saver.

Deduction Basics

The QBI deduction is written off at the owner level. It can be up to 20% of:

- QBI earned from a sole proprietorship or single-member LLC that’s treated as a sole proprietorship for tax purposes, plus

- QBI from a pass-through entity, meaning a partnership, LLC that’s treated as a partnership for tax purposes or S corporation.

Continue Reading

Some people mistakenly believe that Social Security benefits are always free from federal income tax. Unfortunately, that’s often not the case. In fact, depending on how much overall income you have, up to 85% of your benefits could be hit with federal income tax.

While the truth about the federal income tax bite on Social Security benefits may be painful, it’s better to understand it. Here are the rules.

Continue Reading

Unemployment has been holding steady recently at 3.7%. But there are still some people losing their jobs — particularly in certain industries including technology and media. If you’re laid off or terminated from employment, taxes are likely the last thing on your mind. However, there are tax implications due to your altered employment circumstances.

Depending on your situation, the tax aspects can be complex and require you to make decisions that may affect your tax bill for this year and for years to come. Be aware of these three areas.

Continue Reading

With the high cost of college, many parents begin saving with 529 plans when their children are babies. Contributions to these plans aren’t tax deductible, but they grow tax deferred. Earnings used to pay qualified education expenses can be withdrawn tax-free. However, earnings used for other purposes may be subject to income tax plus a 10% penalty.

What if you have a substantial balance in a 529 plan but your child doesn’t need all the money for college? Perhaps your child decided not to attend college or received a scholarship. Or maybe you saved for private college, but your child attended a lower-priced state university.

Continue Reading

If you’re gathering documents to file your 2023 tax return and you’re concerned that your tax bill may be higher than you’d like, there might still be an opportunity to lower it. If you qualify, you can make a deductible contribution to a traditional IRA right up until the April 15, 2024, filing date and benefit from the tax savings on your 2023 return.

Who Is Eligible?

You can make a deductible contribution to a traditional IRA if:

- You and your spouse aren’t active participants in an employer-sponsored retirement plan, or

- You or your spouse are an active participant in an employer plan, but your modified adjusted gross income (AGI) doesn’t exceed certain levels that vary from year to year by filing status.

Continue Reading

A recent report shows that post-pandemic global business travel is going strong. The market reached $665.3 billion in 2022 and is estimated to hit $928.4 billion by 2030, according to a report from Research and Markets. If you own your own company and travel for business, you may wonder whether you can deduct the costs of having your spouse accompany you on trips.

Is Your Spouse an Employee?

The rules for deducting a spouse’s travel costs are very restrictive. First of all, to qualify for the deduction, your spouse must be your employee. This means you can’t deduct the travel costs of a spouse, even if his or her presence has a bona fide business purpose, unless the spouse is an employee of your business. This requirement prevents tax deductibility in most cases.

Continue Reading

Businesses basically have two accounting methods to figure their taxable income: cash and accrual. Many businesses have a choice of which method to use for tax purposes. The cash method often provides significant tax benefits for eligible businesses, though some may be better off using the accrual method. Thus, it may be prudent for your business to evaluate its method to ensure that it’s the most advantageous approach.

Eligibility to Use the Cash Method

“Small businesses,” as defined by the tax code, are generally eligible to use either cash or accrual accounting for tax purposes. (Some businesses may also be eligible to use various hybrid approaches.) Before the Tax Cuts and Jobs Act (TCJA) took effect, the gross receipts threshold for classification as a small business varied from $1 million to $10 million depending on how a business was structured, its industry and factors involving inventory.

Continue Reading

Did you make large gifts to your children, grandchildren or others last year? If so, it’s important to determine if you’re required to file a 2023 gift tax return. In some cases, it might be beneficial to file one — even if it’s not required.

Who Must File?

The annual gift tax exclusion has increased in 2024 to $18,000 but was $17,000 for 2023. Generally, you must file a gift tax return for 2023 if, during the tax year, you made gifts:

- That exceeded the $17,000-per-recipient gift tax annual exclusion for 2023 (other than to your U.S. citizen spouse),

- That you wish to split with your spouse to take advantage of your combined $34,000 annual exclusion for 2023,

- That exceeded the $175,000 annual exclusion in 2023 for gifts to a noncitizen spouse,

- To a Section 529 college savings plan and wish to accelerate up to five years’ worth of annual exclusions ($85,000) into 2023,

- Of future interests — such as remainder interests in a trust — regardless of the amount, or

- Of jointly held or community property.

Continue Reading

Did you donate to charity last year? Acknowledgment letters from the charities you gave to may have already shown up in your mailbox. But if you don’t receive such a letter, can you still claim a deduction for the gift on your 2023 income tax return? It depends.

What the Law Requires

To prove a charitable donation for which you claim a tax deduction, you must comply with IRS substantiation requirements. For a donation of $250 or more, this includes obtaining a contemporaneous written acknowledgment from the charitable organization stating the amount of the donation, whether you received any goods or services in consideration for the donation and the value of any such goods or services.

Continue Reading

When launching a small business, many entrepreneurs start out as sole proprietors. If you’re launching a venture as a sole proprietorship, you need to understand the tax issues involved.

Here are nine considerations:

Continue Reading

When you file your tax return, a tax filing status must be chosen. This status is used to determine your standard deduction, tax rates, eligibility for certain tax breaks and your correct tax.

The five filing statuses are:

- Single

- Married filing jointly,

- Married filing separately,

- Head of household, and

- Qualifying surviving spouse.

If you’re married, you may wonder if you should file joint or separate tax returns. It depends on your individual tax situation.

Continue Reading

The Employee Retention Tax Credit (ERTC) was introduced back when COVID-19 temporarily closed many businesses. The credit provided cash that helped enable struggling businesses to retain employees. Even though the ERTC expired for most employers at the end of the third quarter of 2021, it could still be claimed on amended returns after that.

According to the IRS, it began receiving a deluge of “questionable” ERTC claims as some unscrupulous promotors asserted that large tax refunds could easily be obtained — even though there are stringent eligibility requirements. “We saw aggressive marketing around this credit, and well-intentioned businesses were misled into filing claims,” explained IRS Commissioner Danny Werfel.

Continue Reading

Although traditional IRAs and Roth IRAs have been around for decades, the rules involved have changed many times. The Secure 2.0 law, which was enacted at the end of 2022, brought even more changes that made IRAs more advantageous for many taxpayers. What hasn’t changed is that they can help you save for retirement on a tax-favored basis. Here’s an overview of the basic rules and some of the recent changes.

Rules for Traditional IRAs

You can make an annual deductible contribution to a traditional IRA if:

- You (and your spouse) aren’t active participants in employer-sponsored retirement plans, or

- You (or your spouse) are active participants in an employer plan, and your modified adjusted gross income (MAGI) doesn’t exceed certain levels that vary annually by filing status.

Continue Reading

The IRS announced it will open the 2024 income tax return filing season on January 29. That’s when the tax agency will begin accepting and processing 2023 tax year returns.

Here are answers to seven tax season questions we receive at this time of year.

Continue Reading

1099 Electronic Filing Will Be Required For Most Businesses with W-2 Employees or Businesses with a High Volume of 1099s.

In 2024, the IRS has changed the e-file requirement for informational returns such as W2s, 1099s, 1098s, 1042s, etc. Now, any taxpayer submitting 10 or more information returns, must file those returns electronically.

Continue Reading

If you’re an employer with a business where tipping is routine when providing food and beverages, you may qualify for a federal tax credit involving the Social Security and Medicare (FICA) taxes that you pay on your employees’ tip income.

Credit Fundamentals

The FICA credit applies to tips that your staff members receive from customers when they buy food and beverages. It doesn’t matter if the food and beverages are consumed on or off the premises. Although tips are paid by customers, for FICA purposes, they’re treated as if you paid them to your employees.

Continue Reading

The so-called “kiddie tax” can cause some of a child’s unearned income to be taxed at the parent’s higher marginal federal income tax rates instead of at the usually much lower rates that a child would otherwise pay. For purposes of this federal income tax provision, a “child” can be up to 23 years old. So, the kiddie tax can potentially affect young adults as well as kids.

Kiddie Tax Basics

Perhaps the most important thing to know about this poorly understood provision is that, for a student, the kiddie tax can be an issue until the year that he or she turns age 24. For that year and future years, your child is finally kiddie-tax-exempt.

Continue Reading

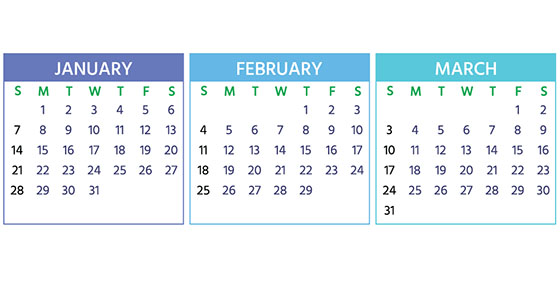

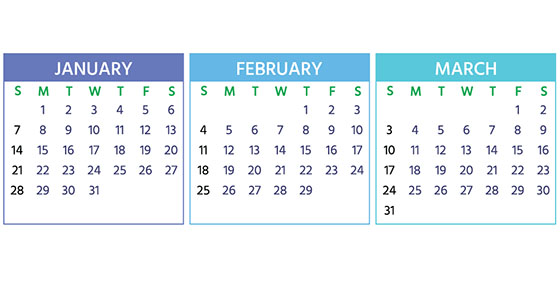

Here are some of the key tax-related deadlines affecting businesses and other employers during the first quarter of 2024. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. If you have questions about filing requirements, contact us. We can ensure you’re meeting all applicable deadlines.

January 16 (The usual deadline of January 15 is a federal holiday)

- Pay the final installment of 2023 estimated tax.

- Farmers and fishermen: Pay estimated tax for 2023. If you don’t pay your estimated tax by January 16, you must file your 2023 return and pay all tax due by March 1, 2024, to avoid an estimated tax penalty.

Continue Reading

The optional standard mileage rate used to calculate the deductible cost of operating an automobile for business will be going up by 1.5 cents per mile in 2024. The IRS recently announced that the cents-per-mile rate for the business use of a car, van, pickup or panel truck will be 67 cents (up from 65.5 cents for 2023).

The increased tax deduction partly reflects the price of gasoline, which is about the same as it was a year ago. On December 21, 2023, the national average price of a gallon of regular gas was $3.12, compared with $3.10 a year earlier, according to AAA Gas Prices.

Continue Reading