If you’re getting ready to retire, you’ll soon experience changes in your lifestyle and income sources that may have numerous tax implications.

Here’s a brief rundown of four tax and financial issues you may deal with when you retire:

Continue Reading

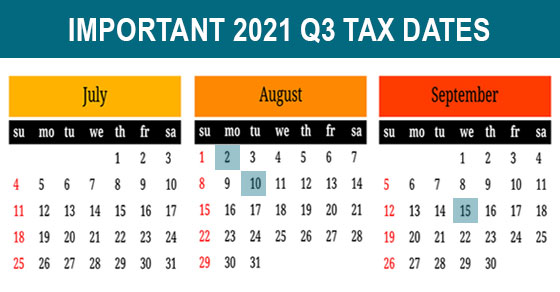

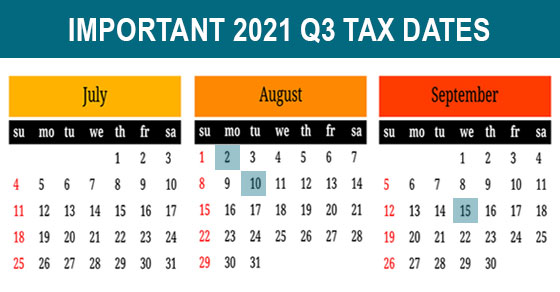

Here are some of the key tax-related deadlines affecting businesses and other employers during the third quarter of 2021. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements.

Continue Reading

If you’re a parent with a college-bound child, you may be concerned about being able to fund future tuition and other higher education costs. You want to take maximum advantage of tax benefits to minimize your expenses. Here are some possible options.

Savings Bonds

Series EE U.S. savings bonds offer two tax-saving opportunities for eligible families when used to finance college:

- You don’t have to report the interest on the bonds for federal tax purposes until the bonds are cashed in, and

- Interest on “qualified” Series EE (and Series I) bonds may be exempt from federal tax if the bond proceeds are used for qualified education expenses.

Continue Reading

Even after your 2020 tax return has been successfully filed with the IRS, you may still have some questions about the return. Here are brief answers to three questions that we’re frequently asked at this time of year.

Are You Wondering When You Will Receive Your Refund?

The IRS has an online tool that can tell you the status of your refund. Go to irs.gov and click on “Get Your Refund Status.” You’ll need your Social Security number, filing status and the exact refund amount.

Continue Reading

When you file your tax return, you must check one of the following filing statuses: Single, married filing jointly, married filing separately, head of household or qualifying widow(er). Who qualifies to file a return as a head of household, which is more favorable than single?

To qualify, you must maintain a household, which for more than half the year, is the principal home of a “qualifying child” or other relative of yours whom you can claim as a dependent (unless you only qualify due to the multiple support rules).

Continue Reading

The IRS recently released guidance providing the 2022 inflation-adjusted amounts for Health Savings Accounts (HSAs).

Fundamentals of HSAs

An HSA is a trust created or organized exclusively for the purpose of paying the “qualified medical expenses” of an “account beneficiary.” An HSA can only be established for the benefit of an “eligible individual” who is covered under a “high deductible health plan.” In addition, a participant can’t be enrolled in Medicare or have other health coverage (exceptions include dental, vision, long-term care, accident and specific disease insurance).

Continue Reading

If you’re a business owner and you hire your children this summer, you can obtain tax breaks and other nontax benefits. The kids can gain on-the-job experience, spend time with you, save for college and learn how to manage money. And you may be able to:

- Shift your high-taxed income into tax-free or low-taxed income,

- Realize payroll tax savings (depending on the child’s age and how your business is organized), and

- Enable retirement plan contributions for the children.

A Legitimate Job

If you hire your child, you get a business tax deduction for employee wage expenses. In turn, the deduction reduces your federal income tax bill, your self-employment tax bill (if applicable), and your state income tax bill (if applicable). However, in order for your business to deduct the wages as a business expense, the work performed by the child must be legitimate and the child’s salary must be reasonable.

Continue Reading

High-income taxpayers face a 3.8% net investment income tax (NIIT) that’s imposed in addition to regular income tax. Fortunately, there are some steps you may be able to take to reduce its impact.

The NIIT applies to you only if modified adjusted gross income (MAGI) exceeds:

- $250,000 for married taxpayers filing jointly and surviving spouses,

- $125,000 for married taxpayers filing separately,

- $200,000 for unmarried taxpayers and heads of household.

Continue Reading

Eligible parents will soon begin receiving payments from the federal government. The IRS announced that the 2021 advance child tax credit (CTC) payments, which were created in the American Rescue Plan Act (ARPA), will begin being made on July 15, 2021.

How Have Child Tax Credits Changed?

The ARPA temporarily expanded and made CTCs refundable for 2021. The law increased the maximum CTC — for 2021 only — to $3,600 for each qualifying child under age 6 and to $3,000 per child for children ages 6 to 17, provided their parents’ income is below a certain threshold.

Continue Reading

While many businesses have been forced to close due to the COVID-19 pandemic, some entrepreneurs have started new small businesses. Many of these people start out operating as sole proprietors. Here are some tax rules and considerations involved in operating with that entity.

The Pass-Through Deduction

To the extent your business generates qualified business income (QBI), you’re eligible to claim the pass-through or QBI deduction, subject to limitations. For tax years through 2025, the deduction can be up to 20% of a pass-through entity owner’s QBI. You can take the deduction even if you don’t itemize deductions on your tax return and instead claim the standard deduction.

Continue Reading

Are you thinking about launching a business with some partners and wondering what type of entity to form? An S corporation may be the most suitable form of business for your new venture. Here’s an explanation of the reasons why.

The biggest advantage of an S corporation over a partnership is that as S corporation shareholders, you won’t be personally liable for corporate debts. In order to receive this protection, it’s important that the corporation be adequately financed, that the existence of the corporation as a separate entity be maintained and that various formalities required by your state be observed (for example, filing articles of incorporation, adopting by-laws, electing a board of directors and holding organizational meetings).

Continue Reading

“Tax day” is just around the corner. This year, the deadline for filing 2020 individual tax returns is Monday, May 17, 2021. The IRS postponed the usual April 15 due date due to the COVID-19 pandemic. If you still aren’t ready to file your return, you should request a tax-filing extension. Anyone can request one and in some special situations, people can receive more time without even asking.

Taxpayers can receive more time to file by submitting a request for an automatic extension on IRS Form 4868. This will extend the filing deadline until October 15, 2021. But be aware that an extension of time to file your return doesn’t grant you an extension of time to pay your taxes. You need to estimate and pay any taxes owed by your regular deadline to help avoid possible penalties. In other words, your 2020 tax payments are still due by May 17.

Continue Reading

The housing market in many parts of the country is strong this spring. If you’re buying or selling a home, you should know how to determine your “basis.”

How It Works

You can claim an itemized deduction on your tax return for real estate taxes and home mortgage interest. Most other home ownership costs can’t be deducted currently. However, these costs may increase your home’s “basis” (your cost for tax purposes). And a higher basis can save taxes when you sell.

Continue Reading

Owners of incorporated businesses know that there’s a tax advantage to taking money out of a C corporation as compensation rather than as dividends. The reason: A corporation can deduct the salaries and bonuses that it pays executives, but not dividend payments. Thus, if funds are paid as dividends, they’re taxed twice, once to the corporation and once to the recipient. Money paid out as compensation is only taxed once — to the employee who receives it.

However, there are limits to how much money you can take out of the corporation this way. Under tax law, compensation can be deducted only to the extent that it’s reasonable. Any unreasonable portion isn’t deductible and, if paid to a shareholder, may be taxed as if it were a dividend. Keep in mind that the IRS is generally more interested in unreasonable compensation payments made to someone “related” to a corporation, such as a shareholder-employee or a member of a shareholder’s family.

Continue Reading

In recent months, there have been a number of tax changes that may affect your individual tax bill. Many of these changes were enacted to help mitigate the financial damage caused by COVID-19.

Here are two changes that may result in tax savings for you on your 2020 or 2021 tax returns. The 2020 return is due on May 17, 2021 (because the IRS extended many due dates from the usual April 15 this year). If you can’t file by that date, you can request an extra six months to file your 2020 tax return by October 15, 2021. Your 2021 return will be due in April of 2022.

Continue Reading

The May 17 deadline for filing your 2020 individual tax return is coming up soon. It’s important to file and pay your tax return on time to avoid penalties imposed by the IRS. Here are the basic rules.

Failure to Pay

Separate penalties apply for failing to pay and failing to file. The failure-to-pay penalty is 1/2% for each month (or partial month) the payment is late. For example, if payment is due May 17 and is made June 22, the penalty is 1% (1/2% times 2 months or partial months). The maximum penalty is 25%.

Continue Reading

Many businesses provide education fringe benefits so their employees can improve their skills and gain additional knowledge. An employee can receive, on a tax-free basis, up to $5,250 each year from his or her employer for educational assistance under a “qualified educational assistance program.”

For this purpose, “education” means any form of instruction or training that improves or develops an individual’s capabilities. It doesn’t matter if it’s job-related or part of a degree program. This includes employer-provided education assistance for graduate-level courses, including those normally taken by an individual pursuing a program leading to a business, medical, law or other advanced academic or professional degree.

Continue Reading

Are you thinking about setting up a retirement plan for yourself and your employees, but you’re worried about the financial commitment and administrative burdens involved in providing a traditional pension plan? Two options to consider are a “simplified employee pension” (SEP) or a “savings incentive match plan for employees” (SIMPLE).

SEPs are intended as an alternative to “qualified” retirement plans, particularly for small businesses. The relative ease of administration and the discretion that you, as the employer, are permitted in deciding whether or not to make annual contributions, are features that are appealing.

Continue Reading

As a business owner, you should be aware that you can save family income and payroll taxes by putting your child on the payroll.

Here are some considerations.

Continue Reading

If you have a life insurance policy, you may want to ensure that the benefits your family will receive after your death won’t be included in your estate. That way, the benefits won’t be subject to federal estate tax.

Current Exemption Amounts

For 2021, the federal estate and gift tax exemption is $11.7 million ($23.4 million for married couples). That’s generous by historical standards but in 2026, the exemption is set to fall to about $6 million ($12 million for married couples) after inflation adjustments — unless Congress changes the law.

Continue Reading

The new American Rescue Plan Act (ARPA) provides eligible families with an enhanced child and dependent care credit for 2021. This is the credit available for expenses a taxpayer pays for the care of qualifying children under the age of 13 so that the taxpayer can be gainfully employed.

Note that a credit reduces your tax bill dollar for dollar.

Continue Reading

If you’re approaching retirement, you probably want to ensure the money you’ve saved in retirement plans lasts as long as possible. If so, be aware that a law was recently enacted that makes significant changes to retirement accounts. The SECURE Act, which was signed into law in late 2019, made a number of changes of interest to those nearing retirement.

You Can Keep Making Traditional IRA Contributions if You’re Still Working

Before 2020, traditional IRA contributions weren’t allowed once you reached age 70½. But now, an individual of any age can make contributions to a traditional IRA, as long as he or she has compensation, which generally means earned income from wages or self-employment. So if you work part time after retiring, or do some work as an independent contractor, you may be able to continue saving in your IRA if you’re otherwise eligible.

Continue Reading

The American Rescue Plan Act, signed into law on March 11, provides a variety of tax and financial relief to help mitigate the effects of the COVID-19 pandemic. Among the many initiatives are direct payments that will be made to eligible individuals. And parents under certain income thresholds will also receive additional payments in the coming months through a greatly revised Child Tax Credit.

Here are some answers to questions about these payments.

Continue Reading

President Biden signed the $1.9 trillion American Rescue Plan Act (ARPA) on March 11. While the new law is best known for the provisions providing relief to individuals, there are also several tax breaks and financial benefits for businesses.

Here are some of the tax highlights of the ARPA.

Continue Reading

If you’re getting ready to file your 2020 tax return, and your tax bill is higher than you’d like, there might still be an opportunity to lower it. If you qualify, you can make a deductible contribution to a traditional IRA right up until the April 15, 2021 filing date and benefit from the tax savings on your 2020 return.

Who Is Eligible?

You can make a deductible contribution to a traditional IRA if:

- You (and your spouse) aren’t an active participant in an employer-sponsored retirement plan, or

- You (or your spouse) are an active participant in an employer plan, but your modified adjusted gross income (AGI) doesn’t exceed certain levels that vary from year-to-year by filing status.

Continue Reading

This year, the optional standard mileage rate used to calculate the deductible costs of operating an automobile for business decreased by one-and-one-half cents, to 56 cents per mile. As a result, you might claim a lower deduction for vehicle-related expenses for 2021 than you could for 2020 or 2019. This is the second year in a row that the cents-per-mile rate has decreased.

Deducting Actual Expenses vs. Cents-Per-Mile

In general, businesses can deduct the actual expenses attributable to business use of vehicles. This includes gas, oil, tires, insurance, repairs, licenses and vehicle registration fees. In addition, you can claim a depreciation allowance for the vehicle. However, in many cases, certain limits apply to depreciation write-offs on vehicles that don’t apply to other types of business assets.

Continue Reading

Although electric vehicles (or EVs) are a small percentage of the cars on the road today, they’re increasing in popularity all the time. And if you buy one, you may be eligible for a federal tax break.

The tax code provides a credit to purchasers of qualifying plug-in electric drive motor vehicles including passenger vehicles and light trucks. The credit is equal to $2,500 plus an additional amount, based on battery capacity, that can’t exceed $5,000. Therefore, the maximum credit allowed for a qualifying EV is $7,500.

Continue Reading

A number of tax-related limits that affect businesses are annually indexed for inflation, and many have increased for 2021. Some stayed the same due to low inflation. And the deduction for business meals has doubled for this year after a new law was enacted at the end of 2020. Here’s a rundown of those that may be important to you and your business.

Social Security Tax

The amount of employees’ earnings that are subject to Social Security tax is capped for 2021 at $142,800 (up from $137,700 for 2020).

Continue Reading

Many people are more concerned about their 2020 tax bills right now than they are about their 2021 tax situations. That’s understandable because your 2020 individual tax return is due to be filed in less than three months (unless you file an extension).

However, it’s a good idea to acquaint yourself with tax amounts that may have changed for 2021. Below are some Q&As about tax amounts for this year.

Continue Reading

The IRS announced it is opening the 2020 individual income tax return filing season on February 12. (This is later than in past years because of a new law that was enacted late in December.) Even if you typically don’t file until much closer to the April 15 deadline (or you file for an extension), consider filing earlier this year. Why? You can potentially protect yourself from tax identity theft — and there may be other benefits, too.

How Is a Person’s Tax Identity Stolen?

In a tax identity theft scheme, a thief uses another individual’s personal information to file a fraudulent tax return early in the filing season and claim a bogus refund.

Continue Reading